“Accounting is the language of a Business”

We can assist and advise you or your business on any tax related matters.

We make sure we provide truly exceptional accounting services. Our qualified and experienced team has over 30 years of experience in the accounting industry of Cyprus.

What is more, we place great value in building solid, long-term relationships with each and every one of our Clients.

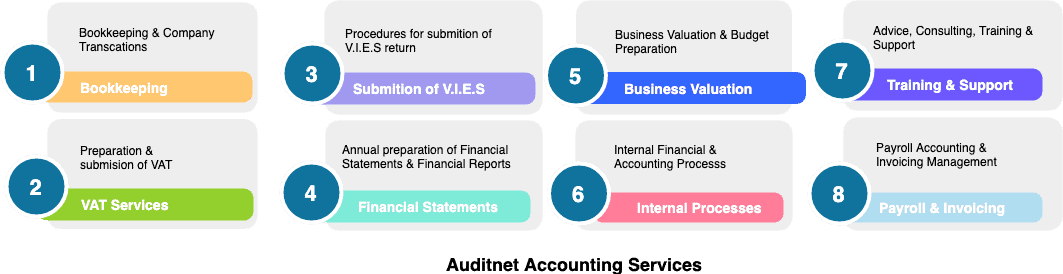

Our accounting services:

• Book-keeping of company transactions (sales, purchases, nominal ledgers, etc.)

• Preparation and submission of VAT services & returns

• Procedures for submission of V.I.E.S. returns

• Annual preparation of Financial Statements and Financial Reports

• Evaluation of Company Performance & Budget Preparation

• Recommendation to improve Internal Financial and Accounting processes

• Advice, Consulting, Training and Support on all our services

• Payroll Accounting Services

• Invoicing Management

Book-keeping of company transactions (sales, purchases, nominal ledgers, etc.)

The process of recording the day-to-day financial transactions of a company such as sales, purchases and nominal ledgers is referred to as Bookkeeping. This is a vital part of accounting and good business management. Adequate bookkeeping will impact the validity of the financial reports created.We can also assist in the correct and timely submission of tax returns to the authorities.

VAT return, Preparation and submission

VAT is imposed on the delivery of goods and services in Cyprus. It is also imposed on the acquisition or importation of goods from other EU Member States. VAT is one of the most complex and stringiest areas of taxation with ever-changing Laws and Legislations.

If VAT returns from the relevant authorities and has not been prepared correctly or in a timely manner, then this will lead to the imposition of hefty fines.

Procedures for submission of V.I.E.S. returns

V.I.E.S. declarations are necessary for the supply of goods and services between EU Member States. VAT registered traders involved in the supply of goods and services have responsibilities to submit a V.I.E.S return. This enables traders to check the validity of VAT registration numbers of their customers and detect the unreported movement of zero-rated goods between Member States.

Annual preparation of Financial Statements and Financial Reports

Financial statements are formal records of the financial activities of a business or entity. Relevant information is presented in a structured form and typically includes:

• a balance sheet (reporting a company’s assets and liabilities);

• an income statement (profit and loss report on a company’s income)

• a cash flow statement.

Financial statements are usually accompanied by a discussion and analysis of the findings, otherwise known as the financial report, which is key to the future planning of the business.

Evaluation of Company Performance & Budget Preparation

Budget preparation and reports which evaluate the actual performance of a company in relation of a budget.

Budget preparation reports include:

• a company’s incoming and outgoing cash flow

• expenses and how a company spends the available funds

We can prepare the budget for your company and also analyse the use of the company’s budget at any given time and determine the funds spent in particular areas.

Evaluate how efficiently funds are managed and allocated to reach the goals of your business.

Recommendation to improve Internal Financial and Accounting processes

We work closely with your employees to become familiars with the ins and outs of your business. We offer professional recommendations on how to improve your accounting processes which in turn will minimize the need for future intervention as well as errors in financial reporting.

Advice, Consulting, Training on all of our Accounting Services

• We can train your staff and offer support to your business.

• We provide advice on all your Audit and Accounting business needs.

• We ensure your business runs smoothly and efficiently, thereby minimizing errors and avoiding mistakes and losses.

Payroll Accounting Services

Payroll accounting involves employee compensation of a company that includes including:

• Gross wages

• Salaries

• Bonuses

• Commissions and funds that have been earned by employees

• Withholding taxes such as income tax

• Social security taxes and insurance premiums

Invoice Management

Invoice Management is the process of managing and processing

• Invoices

• Relevant documents from vendors, suppliers and customers

The process usually involves:

• Receiving the invoice

• Validating and verifying the invoice

• Approving the payment

• Correctly archiving the invoice for future reference

Although it is a tedious process, Invoice Management is crucial to the efficiency of a business which ensures prompt payments are made and increase of cash flow.

We can help you create a sustainable and effective way to incorporate invoicing into your workflow.

CONTACT FORM

Ready to talk with one of our experts?

We work with ambitious companies from all around the world who want to reach their business goals. Together, we can shape your business future and achieve extraordinary results.

Our Business Services